Fungify Pools on Berachain

Fungify Pools is launching on Berachain tomorrow! Pools is a powerful cross-margin lending and borrowing platform that enables you to utilize multiple assets as collateral. With Fungify Pools, you can:

Borrow against your Berachain NFTs

Access your vested BERA tokens immediately

Combine various tokens and NFTs into a unified collateral pool

Fungify Pools is the first platform on Berachain designed specifically to unlock the value of your vesting BERA tokens.

Berachain NFT Details

The core utility of accessing vesting BERA capital from your Berachain NFT requires precise asset valuation. To ensure transparency and fairness, our lending protocol follows a structured and consistent approach to NFT pricing.

NFT Token Allocation (From Berachain)

A total of 34,500,000 BERA tokens were distributed equally across six NFT collections, each managed by a dedicated vesting contract:

BongStream: 0x1E54B85B3632F75E96Cc8d4FcB11BA7f0Ca69213

BondStream: 0xa63b5bc4Bab6593ACc78ef103fcb44A191BAe836

BooStream: 0x1229414CFEE4dEC0B488377B62e96B4094B6258C

BitStream: 0x979EFC29797884c3342143eA7b91E55342F2f408

BandStream: 0xaf30baa667Ce52c1fE5702A0F8CE9A31f0d751B6

BabyStream: 0x14E5930aD47Bfc9E7977547e263D5C3A090b777f

Of these tokens:

25,000,000 BERA tokens (72.5%) were available immediately at launch.

9,500,000 BERA tokens (27.5%) are subject to a three-year linear vesting schedule.

Each NFT's total allocation of BERA tokens can be accessed through the parameter allocationPerNFT, available here.

Vesting Allocation Calculation

The VestingAllocation for each NFT is determined by the following formula:

This calculation reflects the proportion of each NFT's BERA allocation subject to linear vesting over the three-year schedule.

NFT Valuation Methodology

Our valuation model employs a piecewise function that separates the cliff and ongoing vesting:

1. Cliff Vesting (First 1/6th of tokens):

Starts at 50% of the full value at the Berachain launch.

Value linearly increases to full value at the cliff event.

2. Linear Vesting (Remaining tokens over 3 years):

Valued initially at a discount that gradually diminishes from 100% at launch to 0% at the end of the vesting period.

Simultaneously, the total locked token count decreases linearly, further impacting valuation.

Here is the formula in mathematical terms:

Visualizing NFT Valuation Dynamics

Blue Line: Indicates the total locked tokens throughout the three-year vesting.

Red Line: Reflects our proportional valuation of these tokens over time.

Additionally, the NFT's valuation remains sensitive to changes in the $BERA token price, as each NFT's intrinsic value is tied directly to the underlying tokens.

By adhering to this clear and consistent valuation approach, we ensure fair, predictable, and transparent asset pricing within our lending protocol.

Getting Started with Fungify Pools

For those unfamiliar with Fungify Pools, the Berachain deployment closely mirrors the Ethereum mainnet experience. Let's quickly recap its core functionalities:

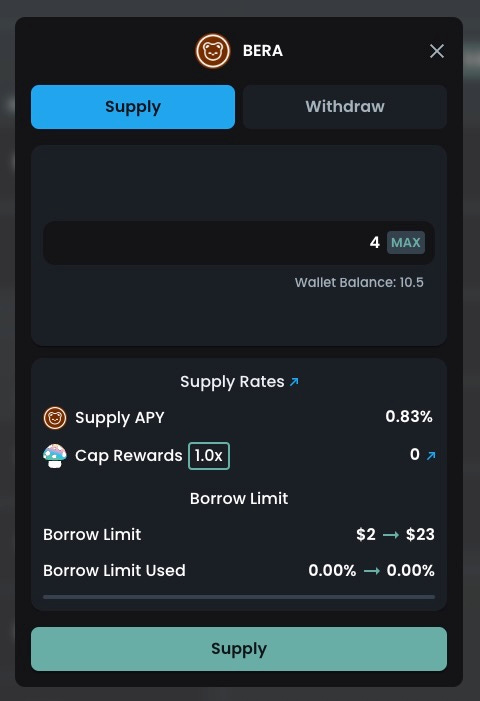

Supplying Assets

Easily supply ERC-20 tokens to the pools.

Your supplied tokens become available for borrowing.

Earn interest when your supplied assets are borrowed.

Interest accrues automatically and directly to suppliers.

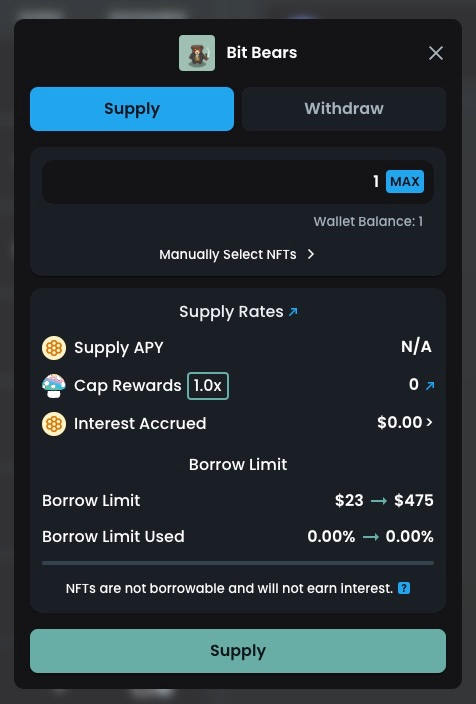

Berachain NFTs

Supply Berachain NFTs to unlock immediate borrowing power based on their vesting BERA tokens.

NFTs act strictly as collateral—you retain ownership as long as loans remain healthy.

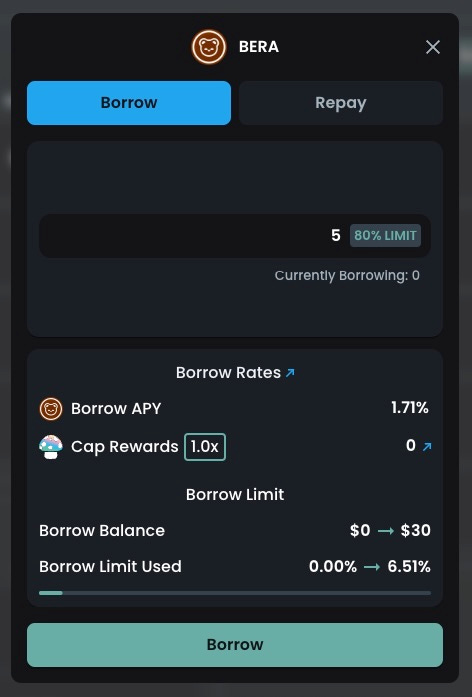

Borrowing

After supplying collateral, you can borrow assets up to your calculated Borrow Limit.

Your Borrow Limit is determined by your total supplied collateral.

Simply select the desired asset and specify the borrow amount.

Regularly monitor your borrowing position to stay within your Borrow Limit.

Repaying Loans

To repay a loan, navigate to your asset position, select the "Repay" option, and enter the desired repayment amount.

Liquidation Mechanics

Positions exceeding their Borrow Limit risk liquidation.

Liquidators can seize collateral at a discount to cover unpaid debts.

The amount of collateral eligible for seizure depends on each asset’s Close Factor.

Token liquidations feature a 6% liquidation incentive.

NFT liquidations offer a discount equivalent to the remaining NFT value.

Multiple assets can be liquidated simultaneously if necessary.

Dynamic Interest Rates

Interest rates adjust dynamically based on asset supply and demand.

Check the "Stats" page regularly to monitor current supply and borrow rates.

Supported Assets

BERA (85% CF)

HONEY (85% CF)

USDC (85% CF)

wBTC (85% CF)

wETH (85% CF)

Baby Bears (35% CF)

Band Bears (35% CF)

Bit Bears (35% CF)

Bond Bears (35% CF)

Bong Bears (35% CF)

Boo Bears (35% CF)

Rewards

Berachain has allocated 16,419.87 BERA tokens for Fungify Pools. We'll distribute these tokens as rewards during our upcoming reward season. Stay tuned for further updates!

Audits

Security is a top priority. Fungify Pools has undergone extensive audits to ensure the platform's safety and reliability:

Hexens: October 23, 2023, November 23, 2023

Least Authority: January 10, 2024

Zach Obront: December 5, 2023

Gaslite: February 27, 2024

About Berachain

Berachain is a high-performance EVM-identical blockchain built on Proof-of-Liquidity consensus. Learn more:

About Fungify

Fungify is a non-custodial NFT peer-to-contract marketplace and algorithmic lending protocol, allowing for instant NFT sales, immediate NFT-backed loans, and a yield-bearing NFT index token. With a small set of elegant primitives, Fungify solves the most challenging problems at the intersection of NFTs and DeFi.

Dive Deeper

Join us on Discord