Fungify Competition Guide

You've been handpicked to participate in the Fungify trading competition. This guide aims to familiarize you with the intricacies of our protocol and the array of strategies at your disposal. Let’s dive in.

Getting Started

You'll begin the competition with mock $500k. Here's how to load it into your wallet. Additionally, to cover gas costs, we'll airdrop 1 ETH to your account.

Additional Gas

You can find a list of faucets here. We recommend topping up daily.

Taking positions

At the heart of this competition are key strategies: longing, shorting NFTs, and utilizing leverage. Let's delve into how you can effectively employ these tactics.

Long Positions:

Bullish on a NFT collection? Purchase NFTs using:

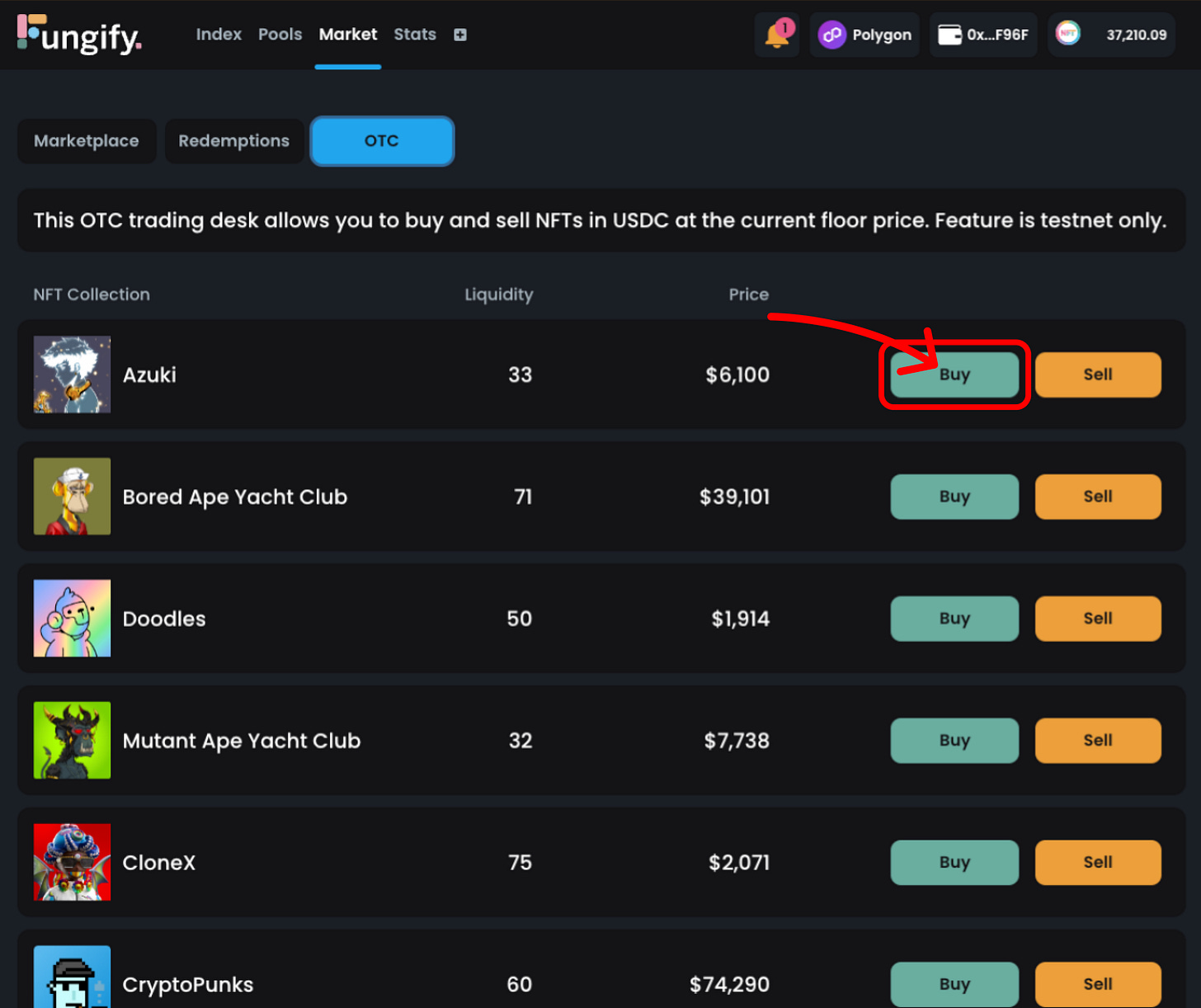

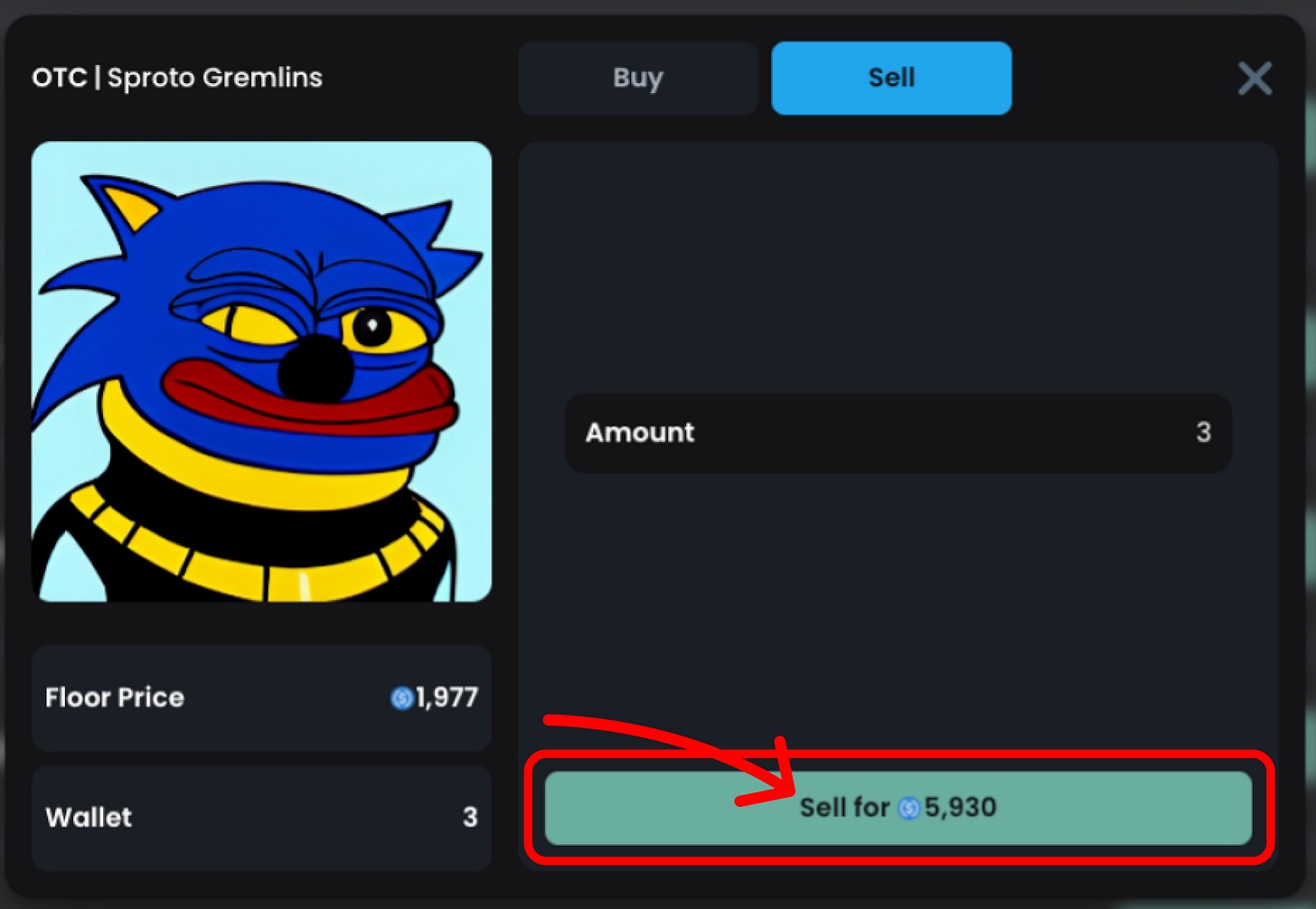

1. OTC

Serving as a dedicated marketplace for this competition, OTC fills the role of platforms like Blur and OpenSea. The prices are anchored to the onchain floor price of the collections. Trading on the OTC market is possible as long as there's sufficient liquidity. It's important to note that this OTC feature has been crafted specifically for the Fungify competition and is not a standard component of the protocol.

2. Fungify Marketplace:

All of the NFTs listed in Fungify’s marketplace are priced in $NFT index token and the prices are set by their owners. These NFTs are currently being used as collateral and being borrowed against. Should the OTC market run low on liquidity, you might find it beneficial to turn to the Fungify Marketplace for acquisitions.

Leverage for Longs:

Purchased some NFTs? Double down and create a leveraged position using Fungify Pools.

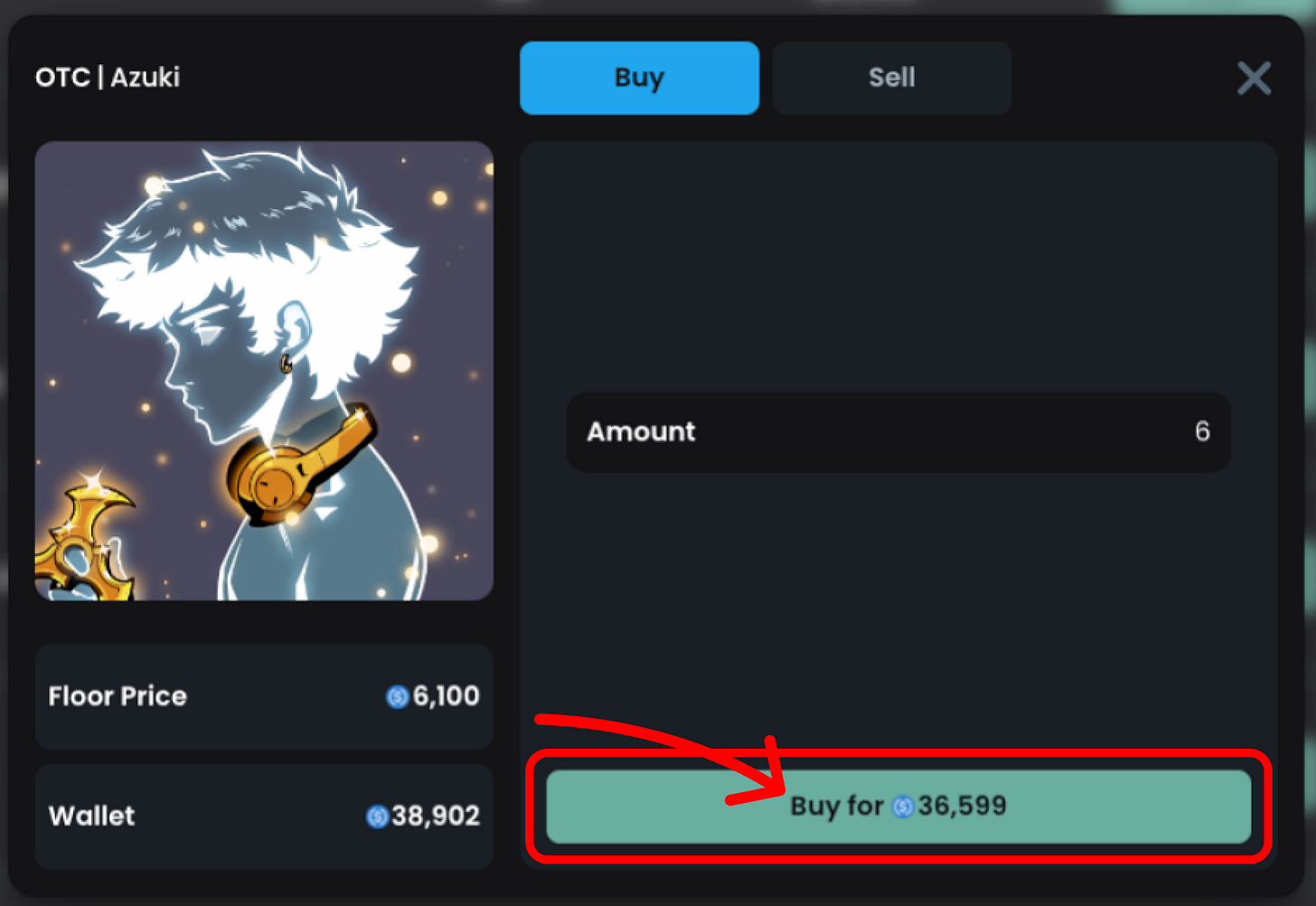

Take this scenario as an example: You're highly optimistic about Azukis and have invested your entire $500k in them. What's next? Leverage those Azukis by using them as collateral to borrow USDC, allowing you to buy even more Azukis. This method can be repeated to amplify your leverage.everage.

And if you're bullish on the entire NFT landscape, opt for the index token and replicate the strategy.

Short Positions:

Fungify introduces the unique capability to short NFTs, allowing you to capitalize when NFT prices drop. Here's the shorting blueprint:

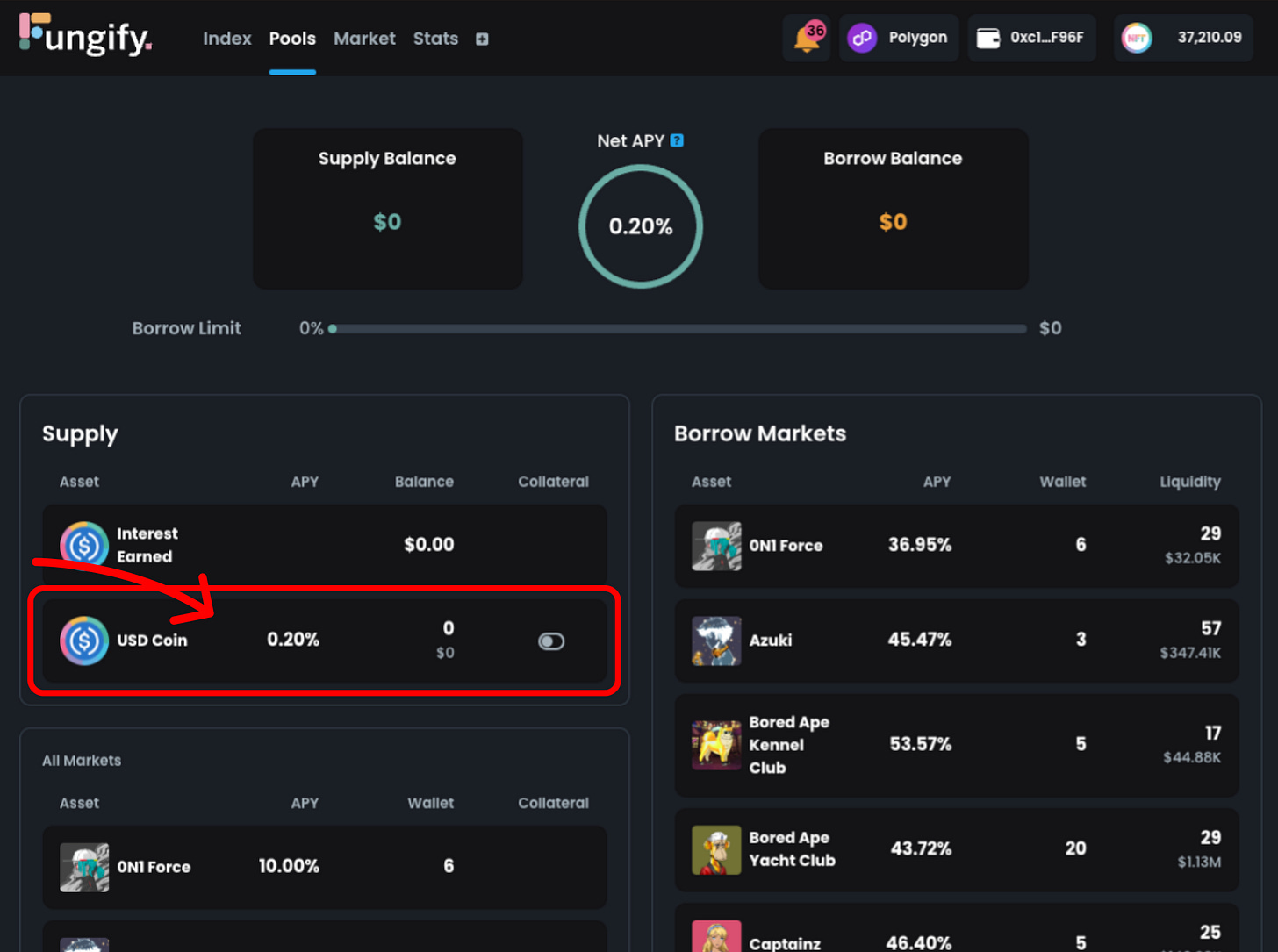

Deposit collateral into Fungify Pools.

Acquire your preferred NFT.

Sell at the OTC desk.

Buy back during price drops.

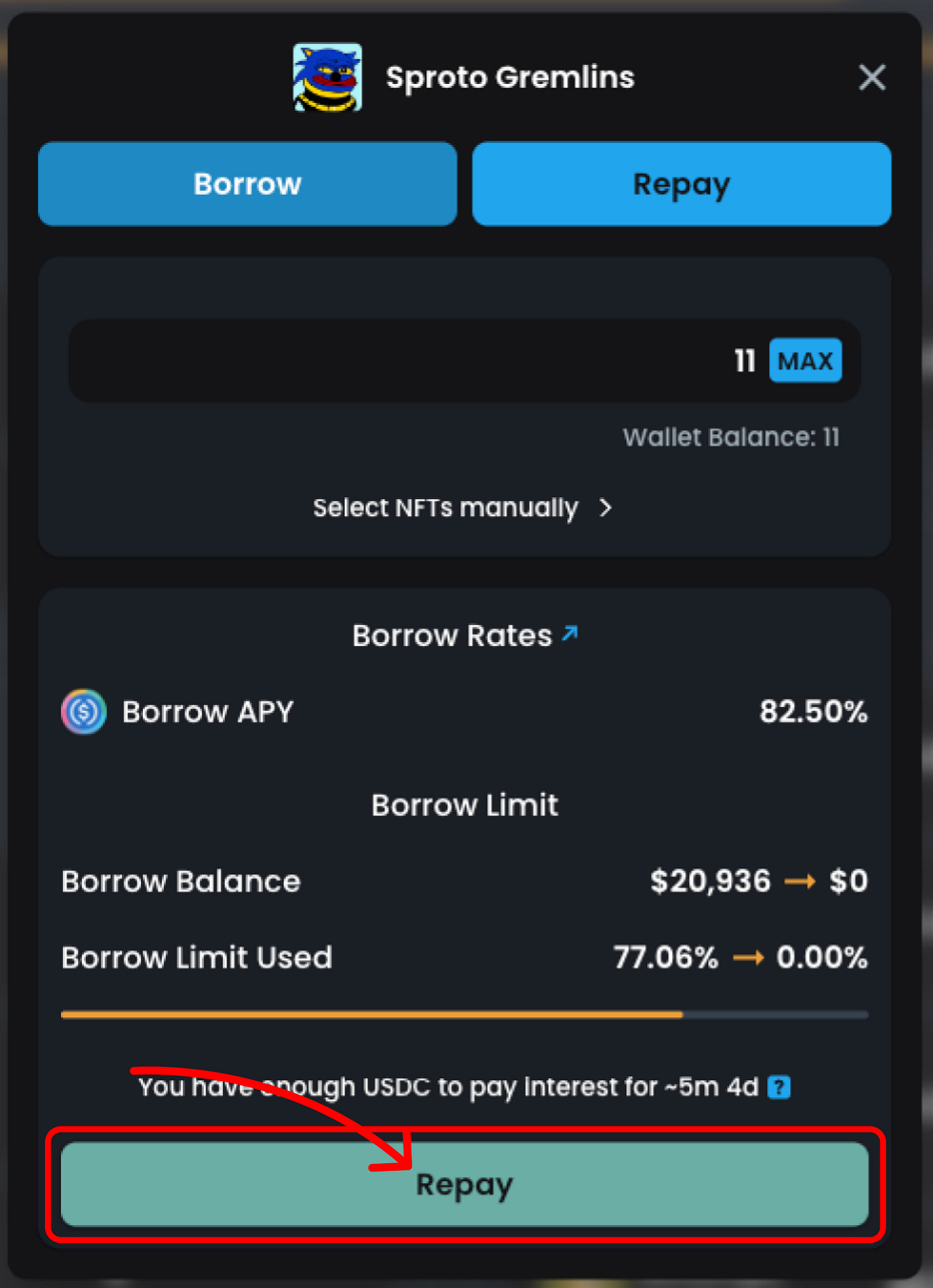

Conclude by returning the borrowed NFT and covering any interest.

Leverage for Shorts:

Just like leverage a long position, you can also leverage your short position. Here's how:

Initiate with a collateral deposit in Fungify Pools.

Borrow your NFT.

Head to the OTC desk for a sale.

Use the derived capital as collateral.

Return to step 1 and cycle through.

Arb the Peg

One of the quickest and clearest ways you can make profit is when you see a deviation in the market price of the index token vs the calculated peg.

If market price of $NFT is above the calculated peg: Buy NFTs from the OTC desk → Sell to index (mint $NFT) → Sell $NFT for fUSDC in the Uniswap Pool.

Here’s a quick video covering the mechanics:

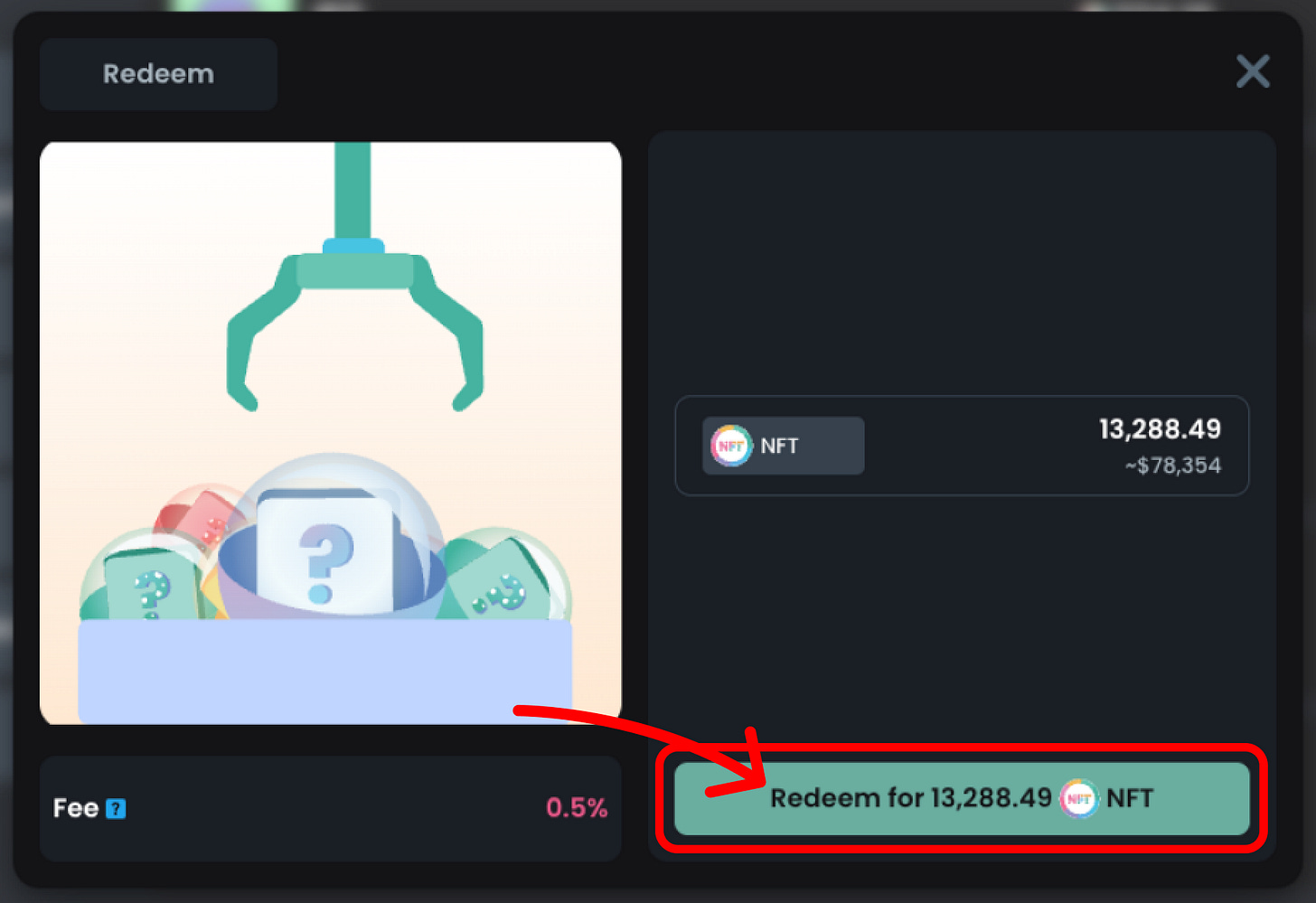

If market price of $NFT is below the calculated peg, buy $NFT—> Burn $NFT to redeem NFTs → Sell at OTC Desk for fUSDC.

In Closing:

The strategies outlined herein represent but a fraction of the potential maneuvers available within the Fungify platform. For a comprehensive understanding, we direct you to the additional resources linked below. As you embark upon this competition, we encourage a collaborative approach; engage actively with your team, share insights, and refine strategies collectively.

Oh and don’t forget about the rules:

Good luck

About Fungify

Fungify is a non-custodial NFT peer-to-contract marketplace and algorithmic lending protocol, allowing for instant NFT sales, immediate NFT-backed loans, and a yield-bearing NFT index token. With a small set of elegant primitives, Fungify solves the most challenging problems at the intersection of NFTs and DeFi.

Dive Deeper

Join us on Discord